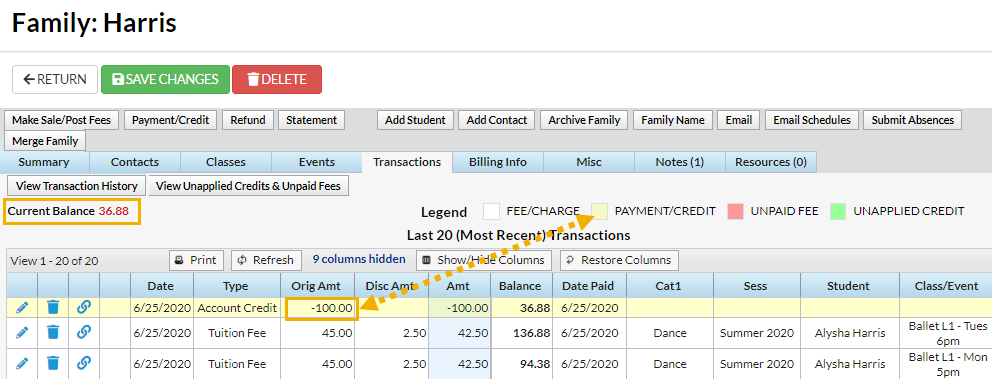

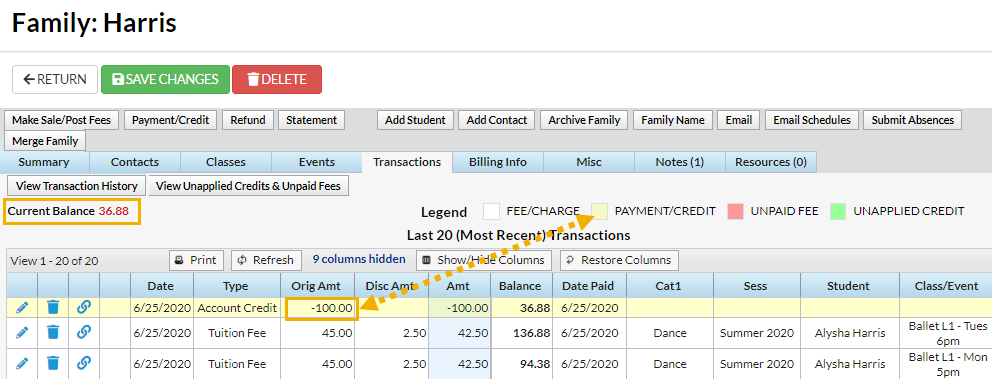

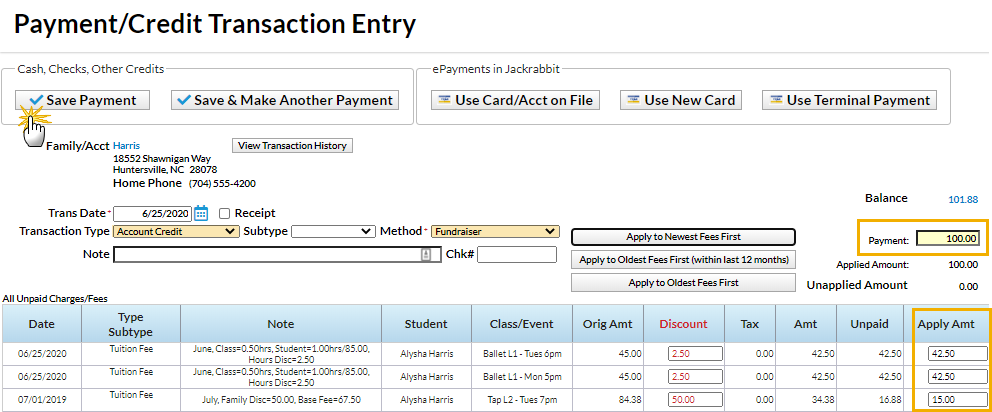

The Harris family sold gift wrap and received a $100 credit toward tuition. They currently have a $136.88 tuition fee posted to their account.

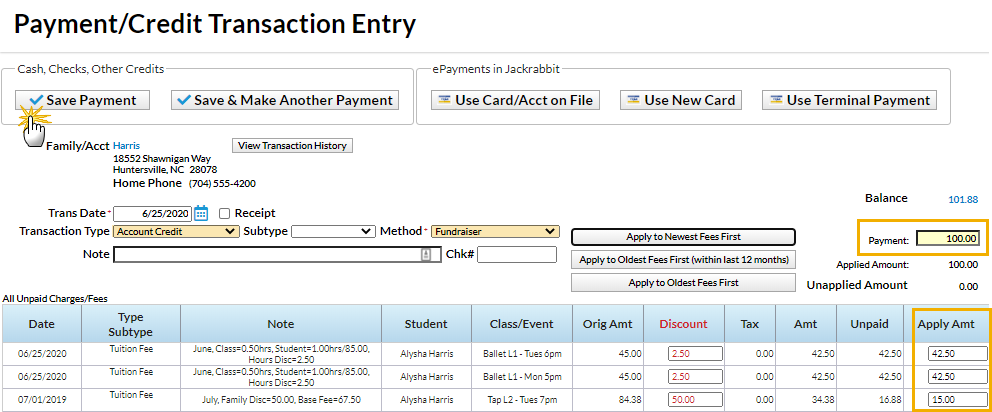

- Ensure you are viewing the correct family. Click the Payment/Credit button.

- Change the Transaction Type to Account Credit.

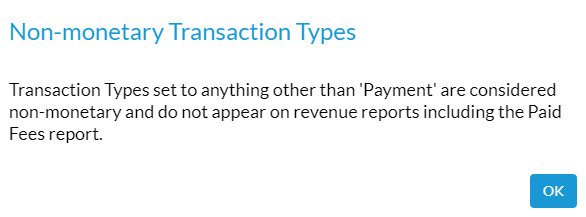

- A warning pop-up will display, Non-monetary Transaction Types. This is to advise you that the credit will not be included in the revenue reports including the Paid Fees report. Click OK.

- A warning pop-up will display, Non-monetary Transaction Types. This is to advise you that the credit will not be included in the revenue reports including the Paid Fees report. Click OK.

- Select Fundraiser (for example) from the Method drop-down list. See Drop-down Lists if you have not yet created this payment method drop-down value.

- Select one of the following:

- Apply to Newest Fees First

- Apply to Oldest Fees First (within last 12 months)

- Apply to Oldest Fees First

- Add a Payment amount for the credit ($100).

- Click the Apply Amt field for the tuition fee(s).

- Click Save Payment.

There was a previous balance on the account and the credit for the fundraising was split as shown. The fundraising credit is added and linked to the tuition fees. The current balance the family owes is $36.88.