Sometimes, despite your best efforts, a family’s balance just can’t be collected. Writing off bad debt helps keep your financial records accurate by removing amounts you’re no longer expecting to receive.

Before writing off a bad debt, there’s an important step to take first. Once that’s done, you can efficiently write off uncollectible amounts when needed.

Add Drop-down List Values

To properly record the bad debt in Jackrabbit, you'll need to add a couple of new drop-down list values.

- Go to the Gear (icon) > Settings > General > Drop-down Lists (left menu).

- Select Transaction Type from the left menu.

- Click the Add Row button.

- Add a new Transaction Type named Bad Debt and select Credit. Save Changes.

- Select Payment Method from the left menu.

- Click the Add Row button.

- Add a new Payment Method named Write-off. Save Changes.

Record the Bad Debt

Once you have created the new drop-down list values, follow these steps to record a bad debt.

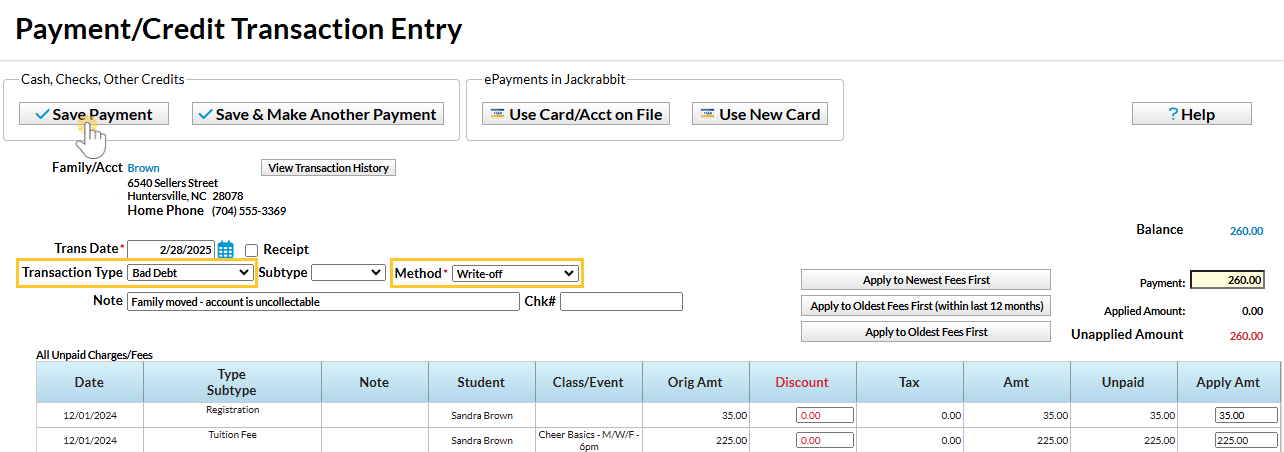

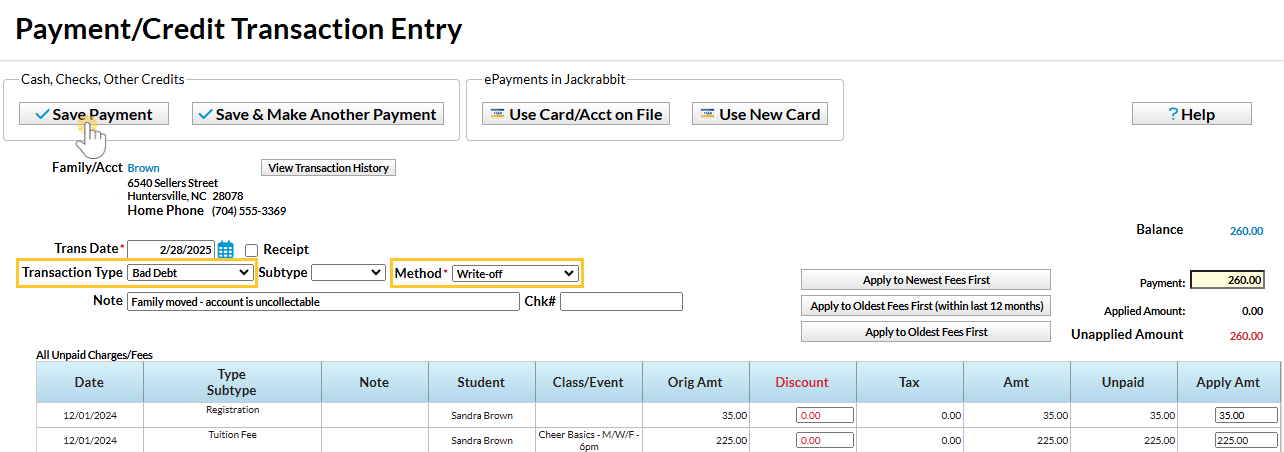

- Go to the record of the family with the uncollectable amount and click the Payment/Credit button.

- Select Bad Debt from the Transaction Type drop-down.

- A window will display advising that a Transaction Type that is set to anything other than Payment is considered non-monetary and does not appear on revenue reports, including the Paid Fees report. Click OK.

- Select Write-off from the Method drop-down.

- Optionally, add a Note.

- Enter the uncollectable amount in the Payment field.

- To select the fees to write off, click in the Apply Amt field. Click Save Payment.

The amount written off reduces the family balance, and the bad debt is linked to the appropriate fees. On the Transactions tab of the Family record, the Transaction Type (Type column) and Payment Method (Pmt Meth column) provide visibility into the transaction at a glance.

Bad Debt Reporting

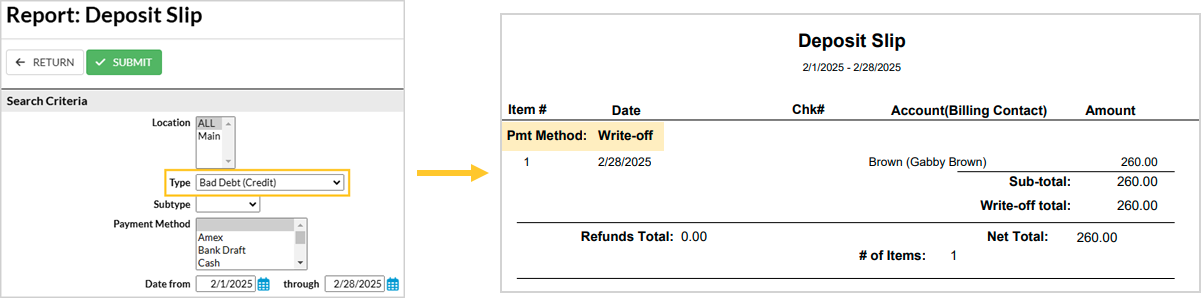

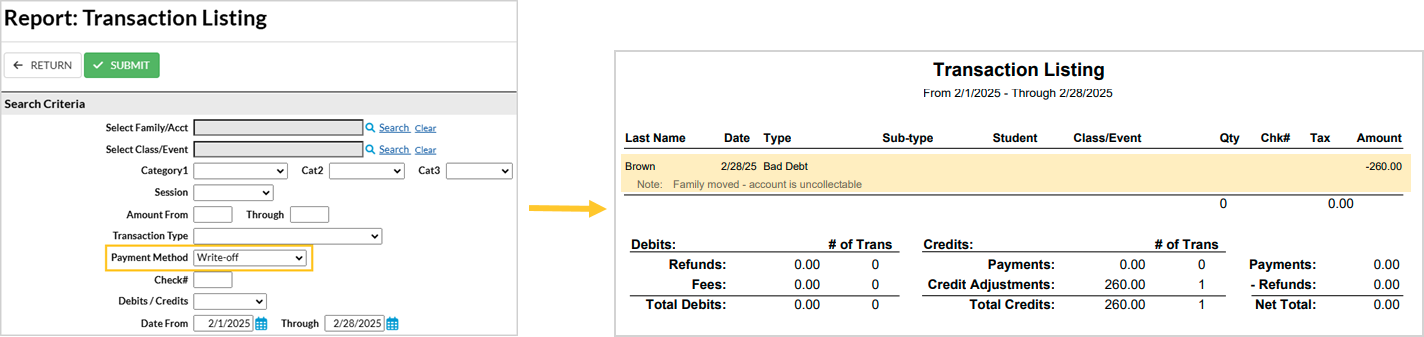

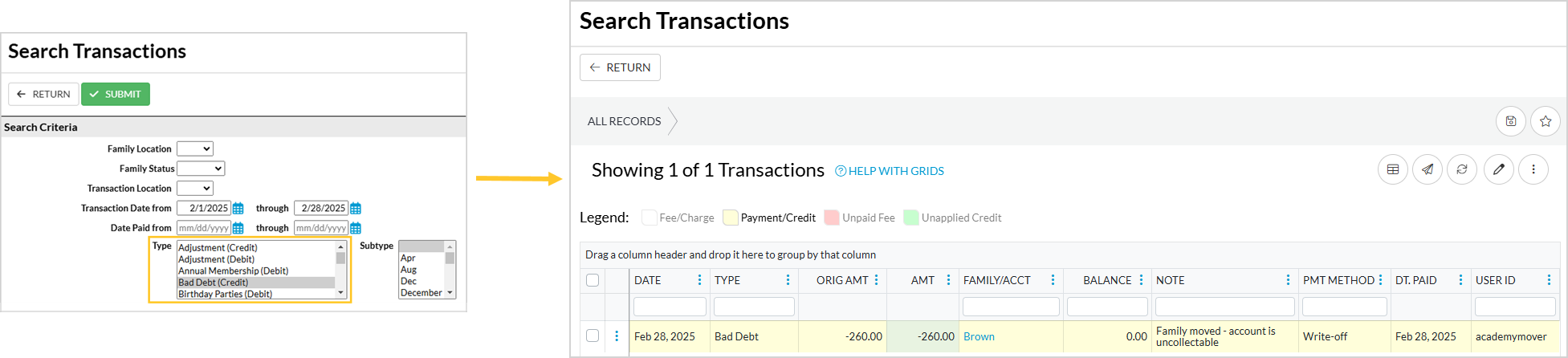

Revenue reports are not impacted because the Transaction Type was changed to a non-monetary credit when the 'payment' was recorded.

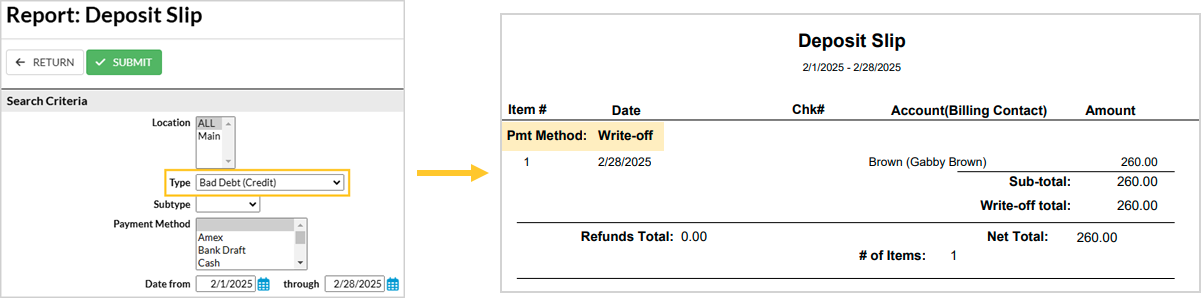

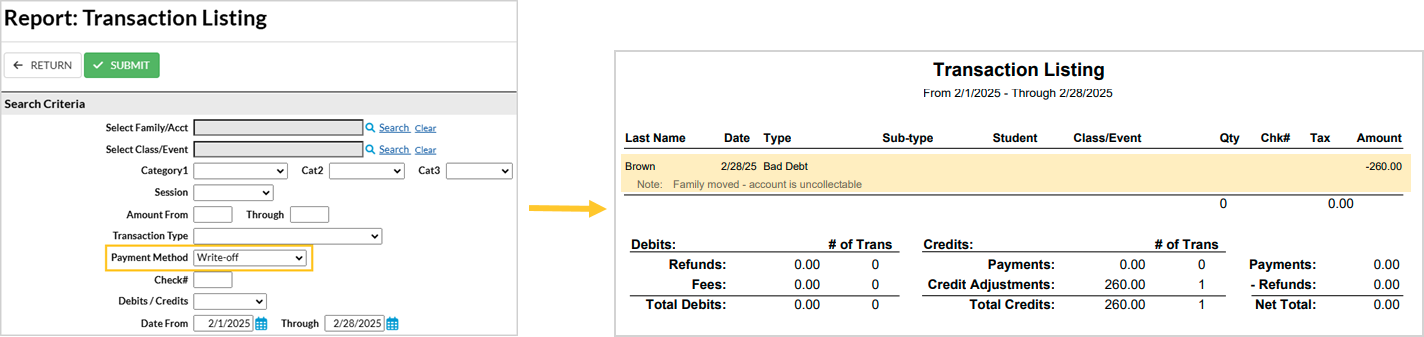

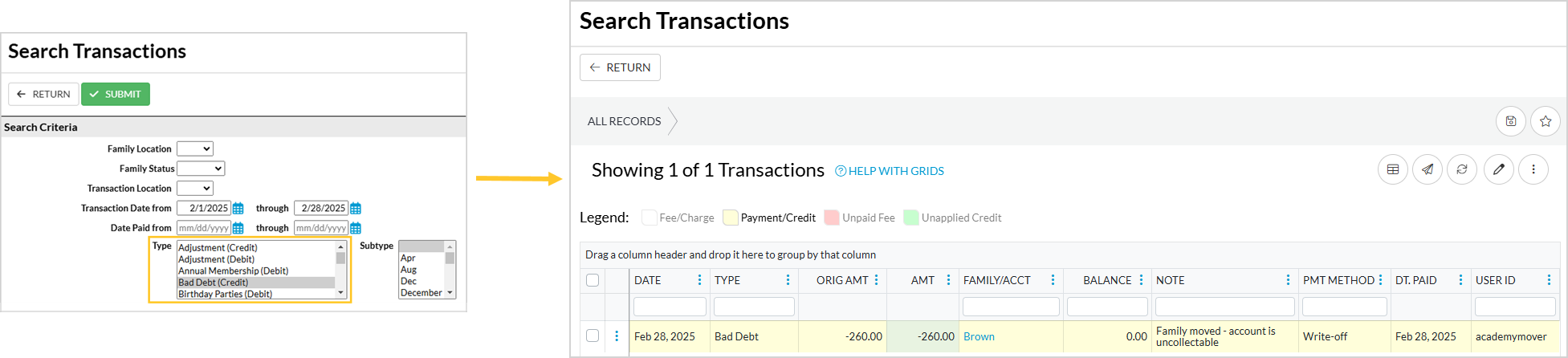

However, you can report on bad debt write-offs using a few other reports.

- Deposit Slip Report - Set the Type Search Criteria to Bad Debt (Credit).

- Transaction Listing Report - Set the Payment Method Search Criteria to Write-off.

- Transaction Search (Transactions menu) - Set the Type Search Criteria to Bad Debt (Credit).

Your Bookkeeper/Accountant will need to be aware of these amounts as they are business expenses.