While the convenience of accepting credit cards empowers your organization to offer customers easy and flexible ways to pay, understanding the true cost of processing credit cards can be anything but easy! Some payment processors use the complexity of credit card costs to confuse merchants, so they believe their fees will be much lower than what they will actually incur. A quick search on the internet will produce many articles that discuss credit card processing rates.

When you use Jackrabbit Pay™, you are provided with 100% Rate Transparency Guarantee pricing that demonstrates what is called your effective rate.

Example

Vendors often approach people with what is implied to be a 'better rate' when it is actually unclear what rate they are really quoting. “I was approached by XYZ Company and they offered me a rate of 1.8%."

Read on to see why that rate is impossible and how you are not getting the full story.

Expand these sections below to read more about credit card rates.

Effective Rate

Ensure you understand what rate you are being quoted. If you currently have a merchant account provider, ensure that you understand what your effective rate is.

Your approximate effective rate is what vendors should use when quoting merchants like you, and it should be the basis for any comparison. If someone is not quoting you the effective rate, they are not telling you the entire story.

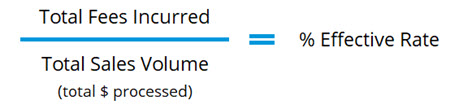

Effective rate is calculated as:

Typically people pay approximately 3% as their effective rate, which considers ALL types of fees including:

| Transactional Fees

(Wholesale) |

|

| Flat Fees

(Markup) |

|

| Incidental Fees

(Markup) |

|

Interchange Fees Explained

Interchange fees make up the majority of the processing fees you'll incur. Charged by the payment processor, interchange rates are part of your total effective rate and are calculated per transaction as a percentage of the transaction plus a flat fee.

Fees vary depending on the type of transaction (debit card versus credit card) and differ based on the type of credit card used (basic card versus reward or corporate cards). This makes it difficult to control your effective rate; you have no control over the type of cards your customers use.

Interchange rates are determined by the card associations and they are collected for the benefit of the card issuing banks for services rendered. They are collected by the payment processors (vendors) and paid for by you, the merchant. It is the cost of using credit card processing services.

Remember our example of being quoted 1.8%? To drive home the point that it is almost impossible to be offered 1.8% as an effective rate, consider that different types of cards have different processing rates. Typically, only debit cards offer a processing rate of 1.8%; therefore, you would have to accept ONLY debit cards to get that processing rate. Since organizations cannot limit their payments to just debit cards, you will almost certainly incur a higher effective rate than the 1.8% quoted. The caveat to this is if you are on a Flat Rate Plan (covered below).

Factors That Impact Rates

Although there is an industry average for interchange rates, your average interchange rate can fluctuate based on several factors:

- What type of cards do you accept (Visa, MC, Discover, Amex)?

- What type of business you are in? Each business is assigned a merchant category code (MCC). The MCC you are assigned determines the rate for that card; you cannot compare your type of business with another business type.

- Are a large majority of credit cards you are processing rewards or corporate cards?

- What is your customer’s average transaction size?

- Are your cards swiped or entered manually?

Rewards Cards - Everyone has them

An example of uncontrollable rates is rewards cards. On average, the typical processing rate for a Visa or MasterCard credit card is 2% or more. However, in the case of rewards cards, you can see interchange costs well over 3%! If your customers mostly present rewards cards for payment, you have no choice but to pay more than 2%. This increased interchange fee is how the card brands offer the additional perks to cardholders, and how you, the merchant, help cover the cost of the rewards programs that are offered.

Processing Fees are Not Negotiable

Interchange fees and assessments are non-negotiable. The wholesale cost of these transactions is passed directly to the merchant (you) from the card issuing banks and the credit card associations. Wholesale fees are fixed amounts regardless of which processor you use.

Markups, including flat fees and incidental fees, are charged by the credit card processor. The amount of markup will differ between processors and they are negotiable.

Look at the Whole Picture

Companies often use crafty marketing techniques like “rates as low as” or “rates starting at” to get you to sign up. Only later is it discovered that the true costs are much higher. In reality, the average credit card processing fees are about 3% of the overall total sales volume that you take in.

Here are the two most common tactics used by processors to lower the average cost they are quoting you.

| ACH bundling |

In order to quote a lower overall cost for processing, processors will bundle in projected ACH (bank auto debits) volumes to lower the expected cost for your merchant services. ACH is typically much less expensive than credit card payments with charges at or below 1% of the overall payment volume drastically reducing the overall average cost. Most companies, however, take less than 10% of their total volume via ACH transactions, much lower than the projection. This makes the cost seem lower than it really is which is very misleading, |

|

Overstating debit card transaction volume |

Debit cards are the most inexpensive type of card to take, but in reality, it's not the card your parents are most likely to use. By factoring in a higher percentage of debit card sales, some processors can make claims about your expected costs, while in reality the probability of you taking a credit card and incurring much greater fees is much higher and more realistic. |

Pricing Models: Flat Rate vs. Tiered Rate

|

Flat Rate

|

Tiered

|

|

|

|

|

Flat Rate Pricing

Compare Jackrabbit Pay™ flat rates to Stripe to see how they measure up.

|

Jackrabbit Pay™

|

Stripe

|

Flat Rate Plan:

|

Flat Rate Plan:

*starting at these rates |

Note that our inclusive rates are nominally lower, but there is also the added benefit of payments integrating with Jackrabbit. Integrating with Jackrabbit means saving time and labor to input transactions.

If you only process a small amount of credit card transactions, the Flat Rate model may work best for you.

Compare Square's Pricing

At first glance, Square’s pricing can seem very attractive when compared to our vendor’s flat rate options. It is important, however, to understand that Square offers different processing rates based on the method of entry of the card, i.e. what method was used to run the payment - card present (cheaper) or card not present (more common).

Square's retail rate (2.6% + .10¢) is only realized if you swipe/dip the credit or debit card through their card reader, meaning the card must be present for the transaction.

Additionally, Square is not integrated with Jackrabbit. Jackrabbit Pay™ is integrated with the software, saving you from manually entering the payments into Jackrabbit. Time spent by you on data entry costs you money!

Decide the Best Solution for Your Business

The ability to offer credit cards is the cost of doing business. The majority of the rates you are paying are determined by the interchange portion of your rates (remember: these are the non-negotiables set by the big credit card companies). Because of the dynamics of consumer credit card types, etc., it is very difficult to control those rates.

Consider building a 3% increase into your current customer pricing (as part of your regular fees) which is considered by some to be sufficient enough to offset the cost of credit card acceptance. It is recommended that if you do this, you do this across the board, regardless of payment method.

Get a rate review with Jackrabbit Pay™

One way to cut payment processing costs is to use a flat-rate pricing model that enables you to pay a set rate per transaction for payment processing regardless of what type of card your customers use. Jackrabbit Pay™ offers a flat-rate plan. Each month you will be charged a fixed % per transaction and a per transaction fee for your processing. No monthly fees, no contracts, and no PCI fees!

Ask Us!

You always have the option to talk with our in-house team of ePayments Specialists. These people are experienced in ePayments and are meant to bridge the gap between your use of Jackrabbit and ePayments. They are responsible for helping answer any questions you have about how ePayments function in Jackrabbit.

If you want to discuss using ePayments in Jackrabbit reach out to us. We are here to help you understand the advantages, and maximize your use of the software. Feel free to book a call here!