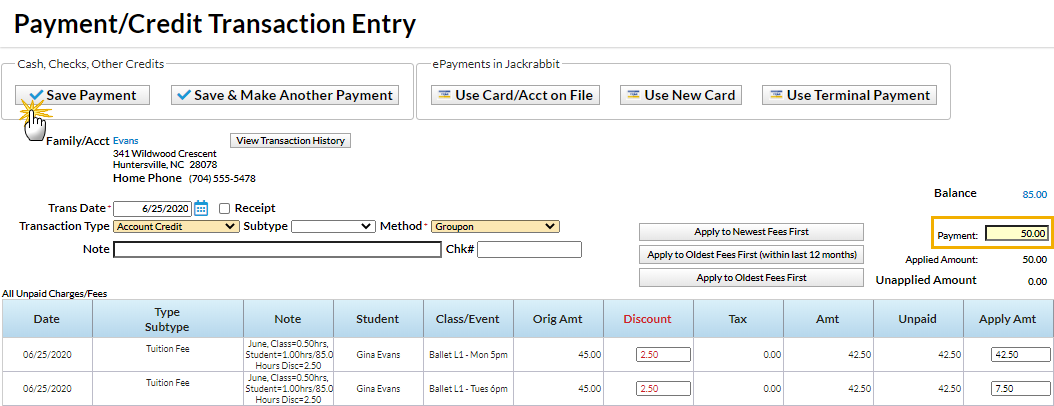

A family purchased a Groupon for $50 off 1 month's tuition fees and is using it towards their June tuition fee of $85 (discounted tuition fee).

- Ensure you are viewing the correct family. Click the Payment/Credit button.

- Change Transaction Type to Account Credit. Note: It is very important that you change the payment type to make sure that the amount is not included in your revenue reports.

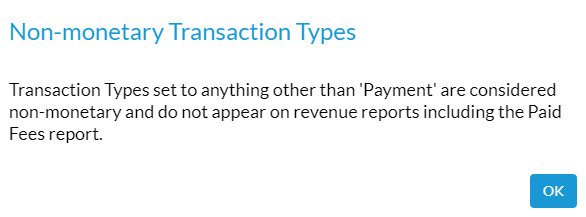

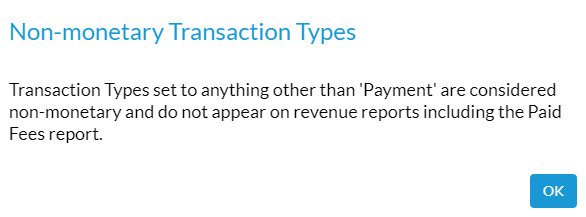

- A warning pop-up will display, Non-monetary Transaction Types. This is to advise you that the credit will not be included in the revenue reports including the Paid Fees report. Click OK.

- A warning pop-up will display, Non-monetary Transaction Types. This is to advise you that the credit will not be included in the revenue reports including the Paid Fees report. Click OK.

- Select Groupon from the Method drop-down list. See Drop-down Lists if you have not yet created this payment method drop-down value.

- Add a Note if needed.

- Enter the amount in the Payment field.

- Select one of the following:

- Apply to Newest Fees First

- Apply to Oldest Fees First (within last 12 months)

- Apply to Oldest Fees First

- Click the Apply Amt field for the correct tuition fee.

- Click Save Payment.

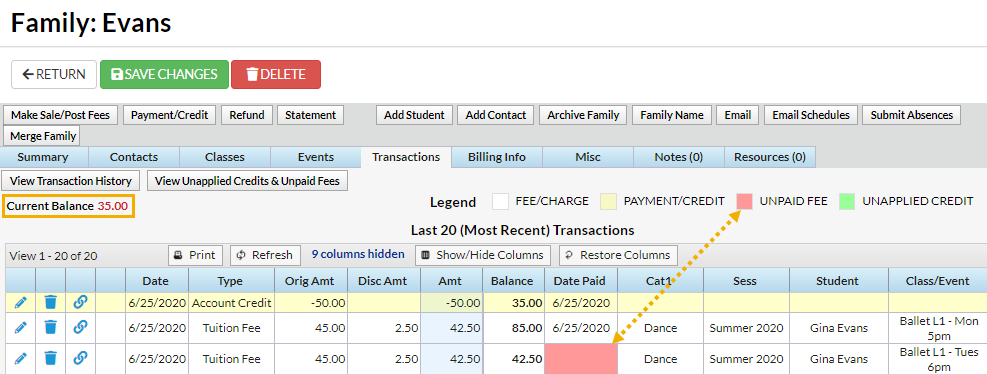

The Groupon $50 credit is added and linked to the tuition fee. The fee still has a pink Date Paid field because it was only partially paid. The family now owes only $35 for June tuition ($85 - less the Groupon).