A family paid a tuition fee and purchased a t-shirt but was charged for two t-shirts in error. They have a $0.00 current balance. One t-shirt ($10.88) will be refunded using the organization's check #10300, and the family's balance will remain at $0.00.

Process a Refund

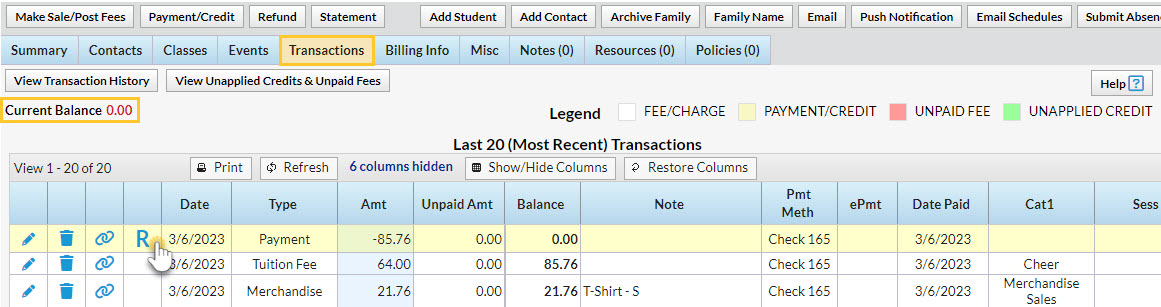

- Click the R icon on the payment line.

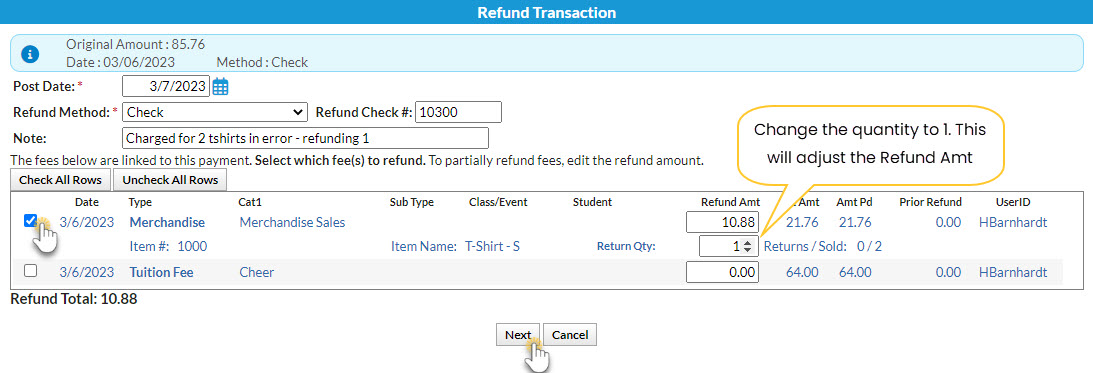

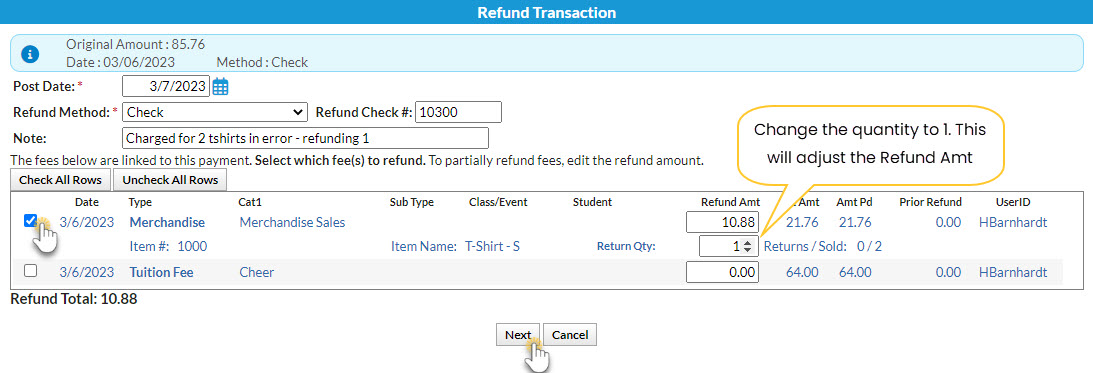

- Change the Post Date if needed.

- Select Check from the Refund Method drop-down and record the Refund Check #.

- Leave the tuition fee unchecked since it's not being refunded.

- Check the Merchandise and change the Return Qty to 1. The Refund Amt will adjust to $10.88. Click Next.

- Click Next in the Are Fees Still Due? window because Store items cannot be marked as still due, and the tuition fee was not selected for refund.

- Leave Add Back Qty on Hand checked in the Are Items Going Back Into Inventory? window. The item will be added back to the inventory count.

- Click Submit Refund.

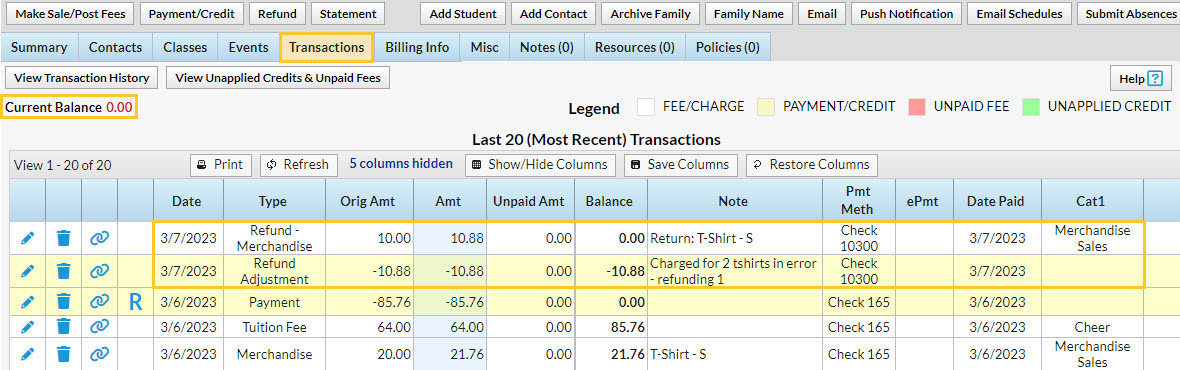

Family Transaction Tab View

- A Refund - Merchandise has been added for $10.88, and a Refund Adjustment has been added so that the family's balance is correct.

- The family balance remains at $0.00.

- The R icon is still visible for the payment because it has not been completely refunded.

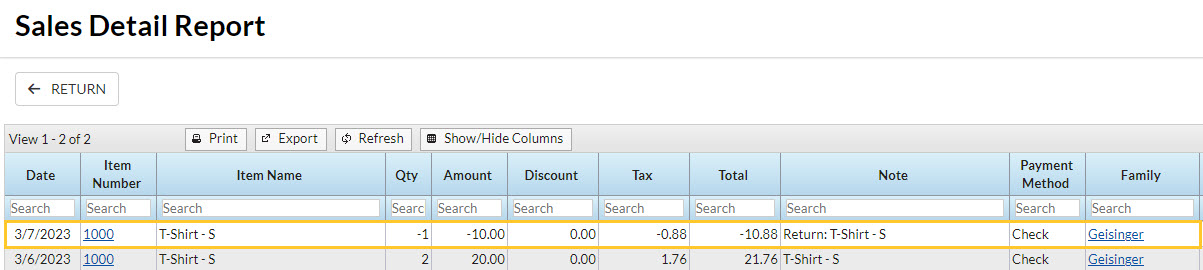

Sales Detail Report View

The return of the t-shirt is recorded, and the Qty returned has been added back to the item's Qty on Hand.