Jackrabbit offers multiple Store reports. These reports give you visibility into your store's operations and allow you to make well-informed decisions.

Reports can help you do all of the following:

- Track store profits.

- Stay aware of inventory levels.

- Keep organized sales tax records.

- Identify your best-selling items.

Use Search Criteria to drill down to the data you want to view. Customize your Report Results by showing or hiding columns and sorting the data.

Search Criteria

Use Search Criteria to narrow the report results:

- Select options, including a Transaction Date range, to specify the data included in your report.

- Click Submit to view the report.

Report Results

The report results can be further customized by showing or hiding columns of information, sorting columns, or modifying column widths.

- The Show/Hide Columns button allows you to customize your report by selecting which information to display.

- Use Restore Columns to view all available columns.

- Print or Export the report as an Excel, CSV, or PDF file.

- Click a column name to sort by that column.

Click the report name below to learn more about what is included in each store report and how to use it.

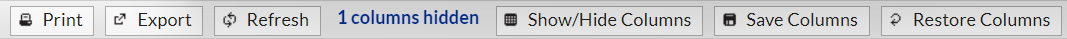

Sales Detail Report

Go to the Store menu > Store Reports > Sales Detail report to display a list of transaction details for items. This is sorted by date (descending order) and then by Item Number (alpha-numeric order).

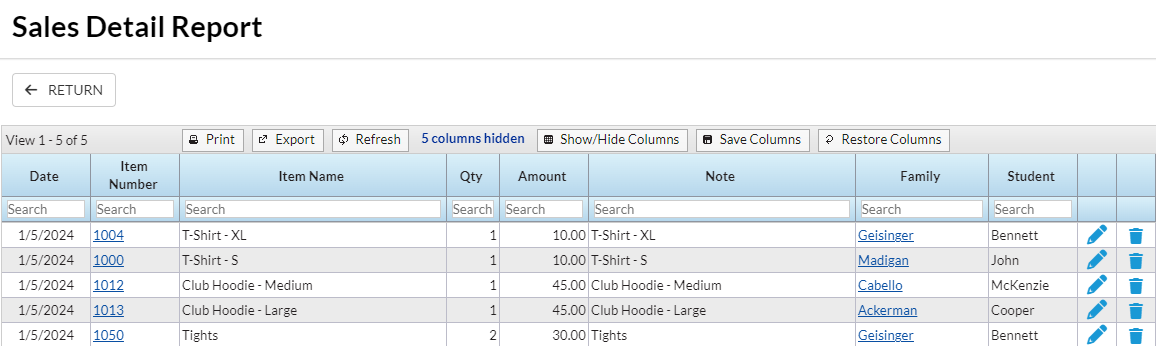

Profit Report

Go to the Store menu > Store Reports > Profit to run a report of total profit on items.

| Net Sales | The Net Sales value displayed on the report for an item is the sum of the Net Sales values for all sales of that item posted during the time frame specified in the Search Criteria for the report. Note: For each item sale, Net Sales is calculated as the Item Price at the time the sale is posted minus any discounts given at that time. |

| Cost | The Cost value displayed on the report for an item is the sum of the Cost values for all sales of that item posted during the time frame specified in the Search Criteria for the report. Note: For each item sale, Cost is calculated as the Item Cost at the time the sale is posted. |

| Profit | The Profit value displayed on the report for an item is calculated from the Net Sales and Cost values on the same row: Profit equals Net Sales minus Cost. |

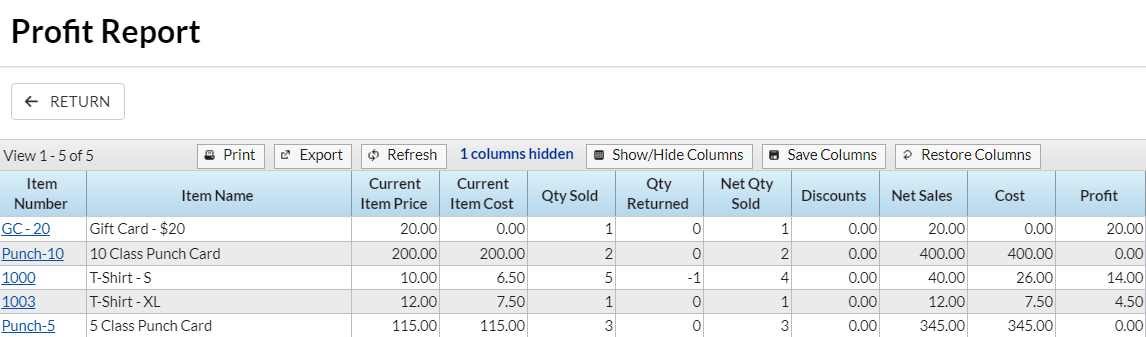

Re-Order Alert Quantity

Go to the Store menu > Store Reports > Re-Order Quantity Alert to run a report that will display a list of items with on-hand quantities at or below their re-order alert quantity.

An Executive Dashboard alert will indicate that items are at or below their re-order quantity alert.

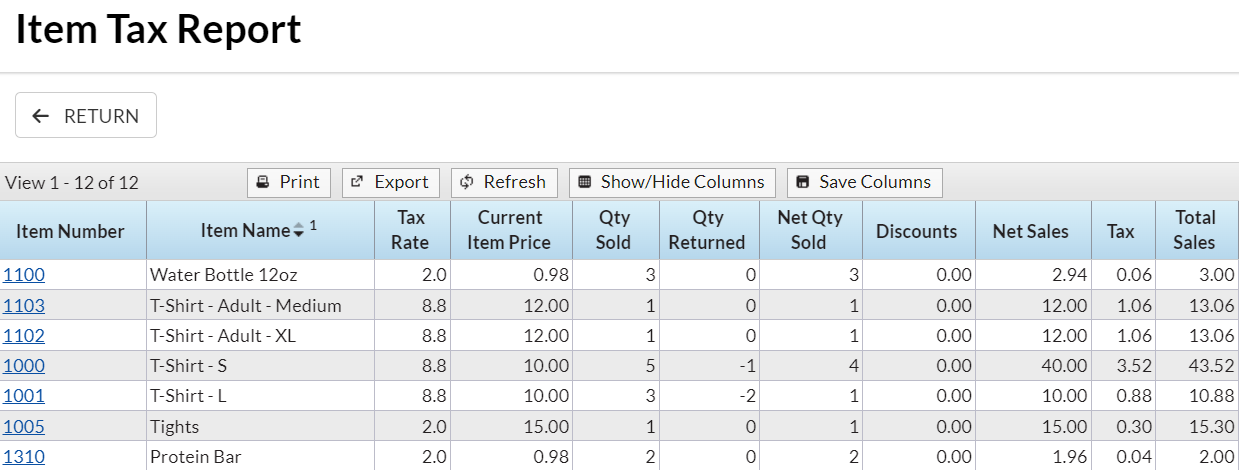

Store Item Tax Report

Go to the Store menu > Store Reports > Store Item Tax to run a report that displays the Tax and Total Sales of items in your store.

- Evaluate net sales for a selected time period.

- Report on sales tax for a given month.

- Analyze discounts given on merchandise.

| Net Sales | The Net Sales value displayed on the report for an item is the sum of the Net Sales values for all sales of that item posted during the time frame specified in the Search Criteria for the report. Note: For each item sale, Net Sales is calculated as the Item Price at the time the sale is posted minus any discounts given at that time. |

| Tax | The Tax value displayed on the report for an item is the sum of the Tax values for all sales of that item posted during the time frame specified in the Search Criteria for the report. Note: For each item sale, Tax is calculated as the tax charged at the time the sale is posted. |

| Total Sales | The Total Sales value displayed on the report for an item is calculated from the Net Sales and Tax values on the same row: Total Sales equals Net Sales plus Cost. |

Save a frequently used report for quick and easy access! Click the Heart icon![]() next to a report name to change the heart to red

next to a report name to change the heart to red![]() and add the report to your Reports menu > My Reports.

and add the report to your Reports menu > My Reports.